What is Bitcoin? | The first cryptocurrency, explained

A beginner-friendly guide to Bitcoin: what it is, how blockchain works, why Bitcoin’s price fluctuates, its advantages and risks, and where to buy BTC safely.

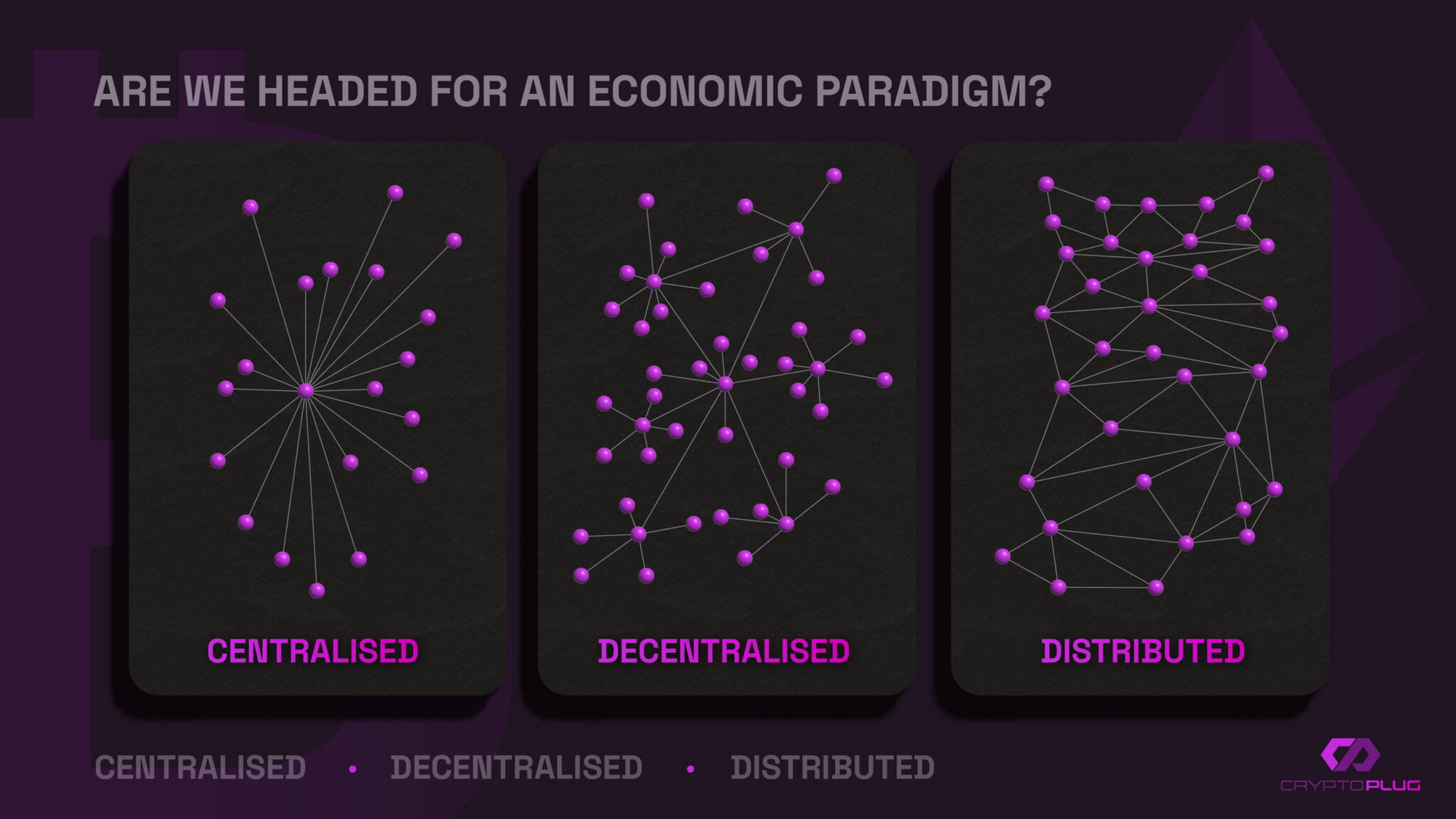

Bitcoin is the first and most valuable cryptocurrency. Before getting into Bitcoin itself, it’s helpful to understand what a blockchain is. In its simplest form, a blockchain is a highly secure digital database, or ledger, that records permanent, tamper-resistant transactions. This database is distributed across thousands of computers known as ‘nodes’, making it extremely difficult to hack or compromise.

There are four defining features of the Bitcoin blockchain.

1. It is peer-to-peer.

Transactions move directly from one participant to another without being processed by a central intermediary such as a bank. When you send or receive bitcoin, the transaction itself is settled on the blockchain rather than through a traditional financial institution. While banks can still regulate fiat on- and off-ramps, they do not control the underlying Bitcoin transaction.

2. It is decentralised.

Unlike the traditional internet (‘Web2’), which relies on centralised servers, the Bitcoin network is distributed across tens of thousands of nodes globally. This means no single entity controls the system. Decision-making and validation are spread across the network, eliminating a single point of failure and making the system highly resilient.

3. It is immutable.

Once recorded, transactions cannot be altered or erased. This permanence makes the Bitcoin blockchain highly secure and trustworthy. To change historical data, an attacker would need to control a majority of the network’s computing power, which is an extremely unlikely scenario at Bitcoin’s current scale.

4. It is public and open-source.

All Bitcoin transactions are publicly viewable and traceable via wallet addresses. In addition, Bitcoin’s codebase is open-source, meaning anyone can inspect it or propose changes, though adoption depends on network consensus.

The first bitcoin was mined in January 2009 by Satoshi Nakamoto, an anonymous developer or group of developers. The goal outlined in the original whitepaper was simple but radical: to enable people to transact directly with one another without relying on trust in a third party.

As a digital currency, bitcoin is designed to function as money outside the control of any single institution, including banks or governments. It also solved the long-standing issue of double spending, which had prevented earlier digital currencies from working at scale.

An increasing number of companies accept bitcoin as a form of payment, including Microsoft, AT&T and PayPal. At a national level, El Salvador continues to recognise bitcoin as legal tender, though its use is voluntary rather than mandatory.

Why does the price of Bitcoin fluctuate so much?

Bitcoin has a notably volatile price history, particularly when compared with traditional currencies or mature asset classes. This volatility is largely a function of Bitcoin’s design, its stage of adoption, and the way it trades within global financial markets.

At a structural level, Bitcoin has a fixed supply. Only 21 million bitcoins will ever exist, and more than 19.5 million have already been mined. New supply enters the market at a predictable pace through mining rewards, which are reduced by half approximately every four years in an event known as the 'halving'. The most recent halving took place in 2024, reducing the block reward to 3.125 BTC. Because supply cannot expand in response to rising demand, price becomes the primary balancing mechanism.

Bitcoin’s market is also still relatively young. While adoption has grown substantially since its early years, it remains in transition between a speculative asset and an established store of value. Periods of increased adoption, technological milestones or shifts in investor confidence can therefore produce sharp price movements in both directions.

In recent years, regulatory developments have played a more visible role. The approval of spot Bitcoin exchange-traded funds (ETFs) marked a significant shift in market access, allowing institutional investors to gain exposure to Bitcoin through familiar, regulated structures. These products introduced new sources of demand by enabling participation from asset managers, pension funds and advisers that were previously unable or unwilling to hold bitcoin directly. In a market with a fixed supply, this expansion of access has had a measurable impact on price dynamics.

Macroeconomic conditions also influence Bitcoin’s valuation. As a globally traded, 24-hour asset, bitcoin responds to changes in liquidity, interest rates, inflation expectations and broader risk sentiment.

Finally, market sentiment continues to carry significant weight. News related to regulation, exchange failures, institutional adoption or geopolitical events can move prices quickly, particularly given Bitcoin’s transparent pricing and relatively shallow liquidity compared with traditional asset classes.

Despite this volatility, many investors view Bitcoin’s fixed supply and decentralised structure as long-term strengths. As markets deepen and participation broadens, price movements may become less extreme over time – but volatility remains a defining feature of Bitcoin today.

Advantages of Bitcoin – Why Users Invest

Despite its price swings, Bitcoin continues to attract millions of users, investors and institutions for a few simple reasons.

Firstly, Bitcoin has a fixed supply. Only 21 million bitcoins will ever exist, and that number cannot be changed. Unlike traditional currencies, which can be expanded by central banks, Bitcoin’s supply is predictable. For many, this scarcity is appealing in a world of rising debt and ongoing money creation.

Like most cryptocurrencies, Bitcoin is decentralised, meaning no single government, bank or company controls the network. Transactions are processed and verified by a global network of independent computers, making Bitcoin resistant to censorship and shutdowns. This is particularly valuable in regions with unstable banking systems or strict capital controls.

Other advantages include:

- Security and transparency. The Bitcoin network has been running since 2009 without being compromised at the protocol level. While exchange failures and scams have led to losses for many users, the Bitcoin blockchain itself is highly secure.

- Global and always on. Bitcoin can be sent anywhere in the world, at any time, without relying on banks, business hours or international payment networks. Large transfers can settle in minutes rather than days.

- Simplicity. Compared with blockchains built for apps, games or complex financial products, Bitcoin has a narrow focus. It exists to function as a decentralised store of value and settlement network, and for many users, that simplicity is exactly the point.

Limitations and Risks of Bitcoin

While Bitcoin offers a number of structural advantages, it also carries meaningful risks – the most obvious being price volatility. Bitcoin’s value can rise or fall sharply over short periods of time, influenced by market sentiment, macroeconomic conditions, regulatory news and liquidity. This makes it unsuitable for some investors, particularly those with short time horizons or low risk tolerance.

Another limitation of Bitcoin, as with all cryptocurrencies, is that transactions are irreversible. Once confirmed on the blockchain, a transaction cannot be undone. If funds are sent to the wrong address or private keys are lost, recovery is usually impossible.

Bitcoin is also subject to regulatory and operational risk. Rules around cryptocurrency vary widely by country and continue to evolve. In addition, while the Bitcoin network itself is secure, many losses in the space have occurred through exchange failures, hacks or scams rather than flaws in the protocol.

Where can I buy BTC?

Bitcoin can be purchased through a range of well-regulated cryptocurrency exchanges and platforms. The most common way to buy bitcoin is through a centralised exchange, such as Binance, Coinbase, Kraken, OKX and Bybit. These platforms allow users to buy bitcoin using fiat currencies such as USD, EUR or GBP, typically via bank transfer or card payment. To use them, you’ll need to create an account and complete KYC.

Once purchased, bitcoin is usually stored in an exchange wallet by default. While this is convenient for small amounts or active trading, many users choose to transfer their bitcoin to a non-custodial wallet for greater control and security.

Bitcoin can also be purchased through brokerage apps, peer-to-peer platforms or Bitcoin ATMs, though fees and availability vary by region. Before buying, it’s important to understand local regulations, fees, custody options and security practices.

As with any financial asset, users should only invest what they can afford to lose.